Share Post:

BMW continues to hold a leading position in the premium automotive sector in 2025.

Rising interest in electrified vehicles and performance models, coupled with technological innovation, drives BMW’s momentum into the new year.

The Neue Klasse platform and an open approach to advanced digital tech serve as key elements of the company’s ongoing transformation.

Table of Contents

ToggleGlobal Sales Snapshot (2024–2025)

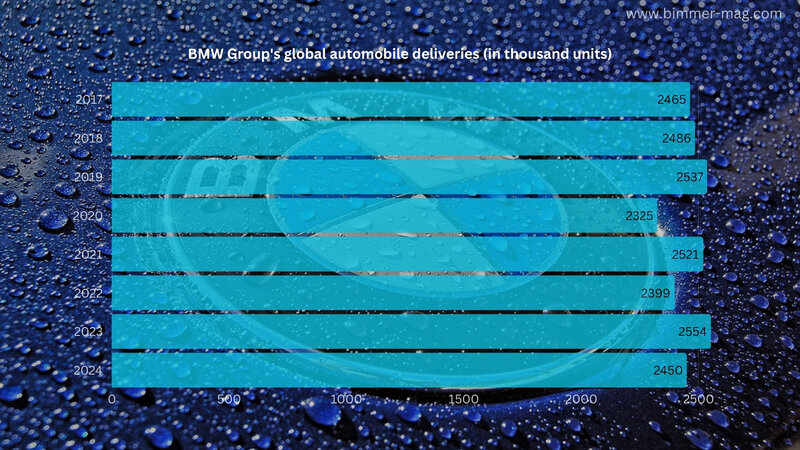

BMW’s global sales dipped by 4% in 2024, largely due to uneven demand and supply pressures in major regions.

Despite that, a rebound appears on the horizon for 2025. Sales of electrified vehicles—battery-electric (BEVs) and plug-in hybrids (PHEVs)—now account for nearly a quarter of all deliveries, signaling a shift in consumer demand.

Momentum builds around the Neue Klasse models, boosted by the sixth-generation eDrive technology.

These innovations have re-energized interest in the brand’s future-facing lineup. While traditional combustion engine models remain relevant in select markets, investment now leans toward electric architecture.

Booming Markets in 2025

Several regions are fueling BMW’s upward momentum in 2025, powered by increasing demand for electrified and luxury vehicles.

Markets embracing sustainability and digital innovation are proving especially lucrative.

Regions with forward-thinking infrastructure, supportive government policies, and a growing appetite for prestige brands are creating space for BMW to grow faster than competitors.

Models anchored in tech sophistication and design excellence, such as the Neue Klasse and iX3, are turning heads and driving new customer acquisition.

Middle East – Dubai

Dubai continues to rise as a hotspot for luxury automotive sales, and BMW is capitalizing on the surge.

You can see a lot of car rental companies in Dubai, like SpeedyMachine, having BMW’s as some of their more luxurious options.

Affluent buyers in the region show strong interest in top-tier models and leading-edge EVs.

Government initiatives favoring electrification help amplify BMW’s presence, aligning well with the company’s BEV roadmap.

Affluent buyers view BMW as a symbol of status and innovation, creating fertile ground for brand expansion.

Robust infrastructure development further supports EV growth in this region.

Key highlights:

- High demand for EVs and performance models

- Dubai’s electrification policies boost adoption

- Anticipated success for Neue Klasse series

United States

Consistent demand for premium vehicles keeps BMW well-positioned in the U.S. market.

Buyers continue to seek both traditional combustion-powered models and plug-in hybrids, with growth particularly strong in states with EV incentives like California.

EV sales are climbing steadily, bolstered by government tax credits and growing infrastructure.

Leasing and financing programs run through BMW Financial Services help sustain interest across multiple buyer segments. Sales performance remains resilient thanks to tailored offerings and continued trust in the brand.

Key highlights:

- Strong performance in EV-supportive states

- Solid leasing and financing penetration

- Balanced interest across drivetrains

Western Europe

Several Western European markets have emerged as strongholds for BMW’s electrified offerings.

The Netherlands, Norway, and the UK lead the charge, driven by emissions regulations and urban clean-air policies. These frameworks push consumers toward low-emission and fully electric vehicles.

BMW’s MINI and i4 models are particularly popular in dense urban areas where premium compact cars dominate. Consumers are drawn to performance, design, and tax incentives, which boost competitiveness in this region.

Key highlights:

- High BEV penetration in eco-regulated markets

- MINI and i4 dominate urban premium space

- Emissions policy reinforces EV growth

Markets Where BMW Sales Are Slowing

Not every market is delivering strong results for BMW in 2025. While some regions are accelerating thanks to electrification and luxury demand, others are signaling a slowdown.

China and Germany, two markets once central to BMW’s volume and strategic strength, now pose challenges.

Economic pressures, fierce competition, and evolving consumer behavior have created headwinds that demand rapid adaptation.

BMW’s approach in these regions involves targeted restructuring, partnership alignment, and a renewed focus on its electric future, but the road ahead remains bumpy.

China

Sales momentum in China has slowed, creating concerns in what has long been one of BMW’s strongest territories.

A surge in domestic EV competition, macroeconomic instability, and delivery issues are pressuring performance. Chinese brands are aggressively pricing electric vehicles, reducing BMW’s advantage in affordability.

Localization efforts and joint ventures like the one with Brilliance Auto aim to restore some balance. Tailored offerings for Chinese buyers and strategic adjustments in pricing and production will be critical for maintaining relevance.

Key challenges:

- Fierce competition from Chinese EV brands

- Consumer caution tied to economy

- Supply and delivery complications

Germany

BMW’s home market shows signs of stagnation. Traditional engine models are seeing waning demand, and even hybrids face lukewarm interest.

Buyers remain cautious amid economic uncertainty and a complex EV transition process.

BMW has responded by investing in showroom redesigns and EV infrastructure support.

Shifts in branding and consumer education will be necessary to drive local enthusiasm for the next generation of electric vehicles.

Key challenges:

- Decline in combustion and hybrid sales

- Economic hesitancy slows adoption

- Focus redirected toward EV transition

Technology as the Differentiator

Product innovation anchors BMW’s strategy for 2025. The Neue Klasse platform and sixth-generation eDrive systems are at the heart of product development.

Efficiency, performance, and range improvements position BMW to compete more effectively in the premium EV space.

The iX3 marks a critical milestone in this transition, signaling the brand’s commitment to electric mobility. Meanwhile, the introduction of the “Heart of Joy” system and software-defined architecture enhances user experience and customization.

Production now leans toward full electrification, while reduced investment costs improve profitability. Strategic manufacturing shifts ensure readiness for EV-focused demand in the years ahead.

Key innovations:

- Neue Klasse and sixth-gen eDrive

- Rollout of iX3 as EV anchor model

- Software-Defined Vehicle and “Heart of Joy” integration

Financial Health and Strategic Investments

BMW maintains stable financial performance despite shifting global dynamics. EBIT margin stood at 6.3% in 2024, with forecasts for 2025 suggesting similar strength.

Controlled spending and a focus on high-margin EVs support long-term profitability

Investments exceeding €18 billion are directed toward new technologies and facility upgrades.

Hungary’s new production plant will anchor manufacturing in Central Europe, while global battery production ramps up to meet EV demand.

Focused capital deployment and operational streamlining place BMW in a strong position to adapt to change while preserving profitability.

Key investments:

- €18B+ directed toward future tech

- New production plants in Hungary

- Global battery factory expansion

The Bottom Line

BMW enters 2025 with a mixed global picture. Booming sales in EV-ready regions like Dubai, the U.S., and parts of Western Europe show promise.

Meanwhile, challenges persist in China and Germany due to market disruptions and evolving buyer preferences.

Confidence in the Neue Klasse lineup and digital-first vehicle strategies lays a strong foundation for growth.

Related Posts: